Corporate Finance: Page 2

-

Waseem Farooq. (2018). "Business meeting" [Photo]. Retrieved from pxhere.

Waseem Farooq. (2018). "Business meeting" [Photo]. Retrieved from pxhere.

Why CFO labor trends center on redesigning teams in 2026

This year’s finance labor trends are being shaped by the growing use of automation, a shift toward internal talent development and the need for CFOs to balance efficiency with adaptability.

By Adam Zaki • Jan. 15, 2026 -

McKinsey’s new AI hiring experiment puts pressure on the ‘up-or-out’ model

For CFOs, the pilot shows how the consulting industry is adjusting to the many promises of artificial intelligence.

By Adam Zaki • Jan. 14, 2026 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineTop 5 stories from CFO.com

From CPA licensure changes to undergoing a digital transformation, these are the most popular stories CFOs are reading.

By CFO.com staff -

Enterprise CFOs see sharp rise in confidence, AI use

A recent Deloitte survey of CFOs at $1B-plus companies shows technology, automation and dealmaking rising on those teams’ finance agendas for 2026.

By Adam Zaki • Jan. 14, 2026 -

SEC drops fraud case against mining CFO

The commission said it has agreed to dismiss the 2017 civil case against Rio Tinto’s former CFO Guy Elliott.

By Dan Niepow • Jan. 12, 2026 -

How the retail apocalypse is showing up on balance sheets: Trial Balance

Closures at Macy’s, GameStop, Starbucks and Walgreens are among the store exits surfacing impairments, lease exits and tougher capital discipline in retail finance.

By Lauren Muskett , Adam Zaki • Jan. 12, 2026 -

What changes most for CFOs when they become CEOs?

After reaching the top job, CFOs who became CEOs reflect on the transition, their responsibilities and what execution really requires.

By Adam Zaki • Jan. 9, 2026 -

The writings of Andy Burt

This collection gathers the editor’s notes from Andy Burt, the former managing director of CFO.com, who passed away at the end of 2025. Written with clarity and restraint, his notes focused on defining his perspective on the life that surrounds finance and accounting. He shared how he th...

By Adam Zaki • Jan. 9, 2026 -

7 finance trends CFOs can’t ignore in 2026

Finance chiefs are entering the year facing new pressures around talent, tax policy, capital allocation and risk.

By Adam Zaki , Dan Niepow • Jan. 8, 2026 -

How finance transformation is becoming a people problem

A new collection of data from the Controllers Council suggests CFOs face new people pressures as automation rises.

By Adam Zaki • Jan. 8, 2026 -

Chicago CFO to depart after city OKs $16.6B budget for 2026

Jill Jaworski, the city’s finance chief since May 2023, is taking a similar job at Chicago’s Navy Pier tourist attraction starting in early February.

By Dan Niepow • Jan. 7, 2026 -

How Uncle Nearest’s finance debacle is becoming a lesson in controls

A lawsuit against the whiskey brand’s former CFO combines misconduct allegations, a nine-figure lender dispute and a court-appointed receivership into a governance case study.

By Adam Zaki • Jan. 7, 2026 -

PwC expands crypto services as stablecoins move into corporate finance

Paul Griggs, chief executive of the firm's U.S. operations, said clearer regulation is increasing conviction around stablecoins.

By Adam Zaki • Jan. 6, 2026 -

Q&A

FloQast CFO on why the demand for accountants is ‘skyrocketing’

Even as companies explore new forms of automation, they’re still on the hunt for accounting talent, says Razzak Jallow.

By Dan Niepow • Jan. 5, 2026 -

10 buzzwords defining trends finance teams faced in 2025

From workslop and microshifting to conscious unbossing, the language of work this year reflected complicated operational and talent risks for CFOs.

By Adam Zaki • Dec. 23, 2025 -

How Bevi’s CFO turned the tap on $100M of annual revenue

Wajeeha Ahmed, the water dispenser maker’s first finance chief, says that sharing financial performance with employees helps drive impact.

By Dan Niepow • Dec. 22, 2025 -

How data and discipline defined the mid-market CFO in 2025

Alignment challenges and capital scrutiny pushed CFOs in the post-startup, pre-IPO realm beyond reporting and into decision support and process recalibration.

By Adam Zaki • Dec. 19, 2025 -

CFOs expect pricing pressures to continue in 2026: Duke-Fed survey

In their most recent quarterly survey, Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta find CFOs expect pricing pressure to persist due to tariffs.

By Adam Zaki • Dec. 17, 2025 -

CFOs targeting both business growth and cost reductions in 2026

A new survey by Gartner shows the “very explicit tension” finance chiefs expect to face in the year ahead.

By Dan Niepow • Dec. 17, 2025 -

How CPA licensure became a CFO issue in 2025

What started as a professional standards debate became a CFO concern tied to audit quality and hiring.

By Adam Zaki • Dec. 16, 2025 -

Cisco CFO highlights rival’s integration as M&A lesson: Trial Balance

At a recent conference, Mark Patterson criticized Hewlett Packard Enterprise’s Juniper integration as a source of customer uncertainty.

By Lauren Muskett , Adam Zaki • Dec. 15, 2025 -

What M&A’s $4.8 trillion comeback means for CFOs

Rising valuations, larger deals and AI’s role in due diligence are expected to impact how many finance teams prepare for 2026.

By Adam Zaki • Dec. 12, 2025 -

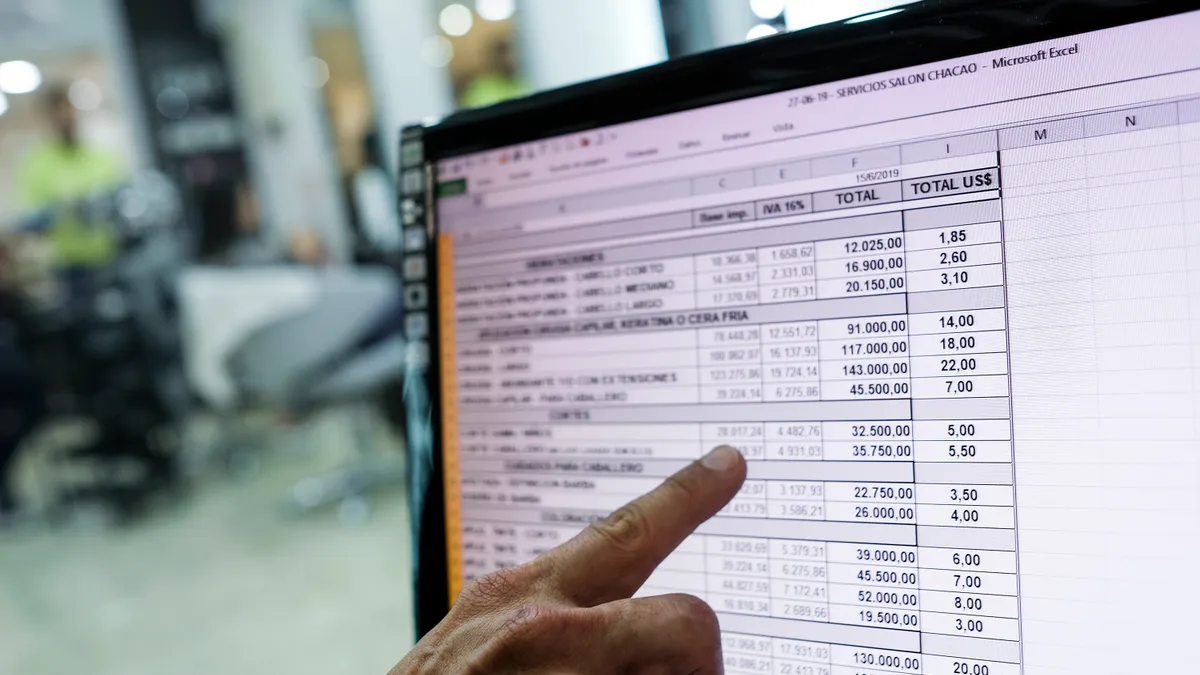

54% of Gen Z finance employees say they ‘love’ Excel

A love-hate relationship that now spans generations is still the driving force that keeps the tool a focal point across corporate finance.

By Adam Zaki • Dec. 10, 2025 -

CFOs expect inflation to linger through 2027

Though more than half of finance chiefs surveyed by CNBC don’t anticipate a recession in the new year, a similar share think inflation will remain above the Fed’s target rate for a while.

By Dan Niepow • Dec. 10, 2025 -

Instacart CFO vies for more partnerships and enterprise customers

In the perpetually competitive world of online grocery, Emily Reuter said enterprise-level offerings remain a “key component” of the company’s broader strategy.

By Dan Niepow • Dec. 9, 2025 -

Finance leaders project modest revenue and profit gains in 2026

Despite a decline in optimism about the U.S. economy at large, finance execs are feeling pretty good about their own companies’ prospects.

By Dan Niepow • Dec. 9, 2025