The Trial Balance is CFO’s weekly preview of stories, stats, and events to help you prepare.

Part 1: MedSpeed’s CFO and Employee Thoughts on AI

This week, reporter Adam Zaki will publish a Q&A with MedSpeed’s CFO Natalie Laackman. Zaki and Laackman discuss the logistical demands her company faces, her thoughts on internal salary transparency, and her recent experience as a keynote speaker at SuiteWorld. (10/26)

Zaki will also run a story on new survey data from Workplace Intelligence and UKG that is currently embargoed. The data highlights employee sentiment on their involvement in AI incorporation within their companies. (10/25)

Senior Reporter-at-Large Vincent Ryan explores why now is not the best time to go public (10/24) and how companies can get better at CFO succession planning (10/27).

Part 2: This Week

Investors are jumpy. Six of the “Magnificent Seven” tech giants report third-quarter earnings this week (see full list below), but chances are any positive performance numbers will be drowned out by the surge in bond yields and news out of Israel and Gaza. Even if tech earnings are robust, investors are driving down share prices when earnings reports contain the slightest hints of vulnerabilities. The S&P 500 is still up nearly 10% this year but is down almost 4% since last Monday.

Only one initial public offering is scheduled this week, a $200 million deal from Mach Natural Resources. Two small offerings were filed on Monday: electric car-sharing platform EV Mobility, hoping to raise $9 million at $4 to $6 per share, and direct-to-consumer apparel retailer JP Outfitters, looking to raise $10 million at $4 per share.

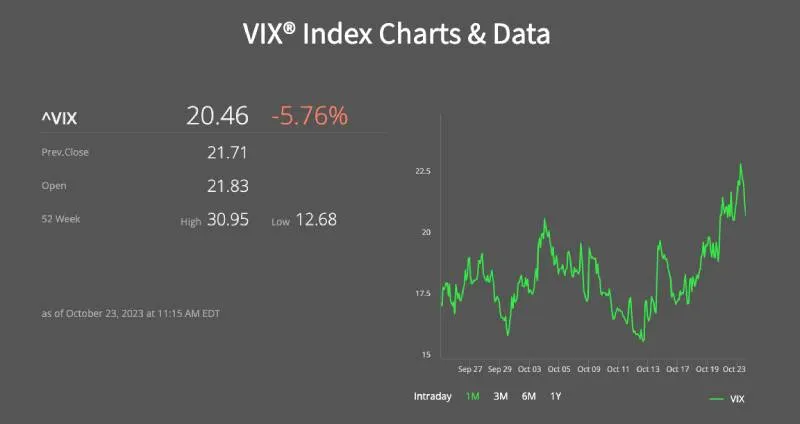

The CBOE Volatility Index hit 22 on Monday morning then fell back near 20. In addition to the poor aftermarket performance of recent IPOs, that will keep most potential issuers on the sidelines. The lack of exit options is putting pressure on mature venture capital-funded firms. But VC firms are also pulling back on early-stage deals, with investments in U.S. startups at $89.3 billion in the first three quarters of the year, down 45% from 2022, according to Global Data.

Headlining economic data this week is the first estimate of third-quarter U.S. gross domestic product. The median forecast for real GDP growth is 4.5%, up from 2.1% in the second quarter. Economists and Fed funds futures pricing don’t expect the large number to spur the Federal Reserve to raise the Fed funds rate next week.

Economists expect inflation to have fallen slightly last month. On Friday, the Bureau of Economic Analysis releases September's personal consumption expenditures (PCE) price index. The median forecast for year-over-year core PCE (which excludes food and energy and is the Fed’s preferred inflation gauge) is 3.7%, down from 3.9% the prior month.

Securities and Exchange Commission Chair Gary Gensler speaks on Wednesday at the Securities Enforcement Forum 2023 in Washington, D.C. His next target in the securities markets could be activist investors who use derivatives to quietly amass positions in a target stock. The SEC recently adopted a rule to increase transparency in short-selling, another bane of equity issuers.

Earnings this week: Packaging Corporation of America, Microsoft, Alphabet, Visa, Coca-Cola, Texas Instruments, General Electric, Meta Platforms, T-Mobile US, Thermo Fisher Scientific, Boeing, General Dynamics, Amazon.com, Mastercard, Merck & Co., Intel, Altria, Chipotle Mexican Grill, Northrop Grumman, United Parcel Service, Exxon Mobil, Chevron, and Charter Communications. — Vincent Ryan

Part 3: Keys to Better Budgeting

Budgeting done right isn’t a one-time exercise; instead, it should give CFOs a path for ongoing forecasting and analysis, which is a heavy lift without the right process, technology, and data in place. A new column from Accordion offers a practical roadmap for CFOs who want to implement a more effective budgeting process. (10/24)