As part of the Biden Administration’s promise to toughen enforcement of U.S. antitrust laws, the U.S. Department of Justice and the Federal Trade Commission on Wednesday introduced long-awaited revised guidelines for reviewing proposed mergers and acquisitions.

The draft guidelines are designed to increase transparency and inform agency staff and plaintiffs of the agencies’ aggressive approach toward mergers that dampen competition in the modern economy. They also detail how the agencies will evaluate proposed mergers under federal law.

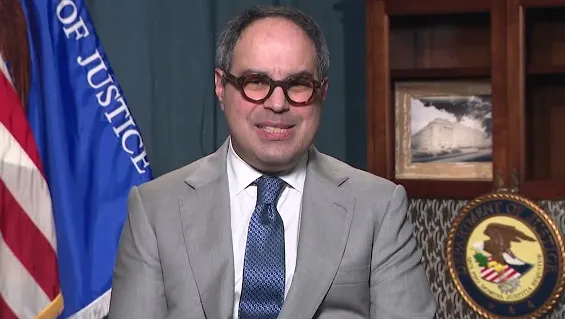

“As markets and commercial realities change, it is vital that we adapt our law enforcement tools to keep pace so that we can protect competition in a manner that reflects the intricacies of our modern economy,” said a statement by Assistant Attorney General Jonathan Kanter of the antitrust division. “Simply put, competition today looks different than it did 50 — or even 15 — years ago.”

In a fact sheet, the DOJ and FTC noted the draft guidelines directly address the potential harm from a deal along “any dimension of competition,” including when a tie-up that is otherwise competitive reduces competition for workers.

The factsheet also stressed the agencies’ desire to take a hardened stance on platform markets and competition, “as they often present high entry barriers and are likely to tip in ways that entrench dominant firms.”

The guidelines are built around 13 core principles, described here. Some guidelines could expand how the FTC and DOJ define anticompetitive deals. For example, the agencies said they would examine a whole series of acquisitions if they form part of a pattern or strategy deemed anti-competitive and would consider the “cumulative effect” of the transactions.

“The intensified regulatory and legal challenges to mergers and strategic partnerships under the Biden administration could temper external growth and limit scale efficiency opportunities, pressuring cash flows.”

Fitch Ratings

The guidelines also indicated that in concentrated markets, the federal government would review mergers that eliminate a potential market entrant.

Lower Event Risk?

“The intensified regulatory and legal challenges to mergers and strategic partnerships under the Biden Administration could temper external growth and limit scale efficiency opportunities, pressuring cash flows,” Fitch Ratings said in a release in early June. Issuers that litigate regulatory disputes could face operational uncertainty and distraction.

However, Fitch said the tougher antitrust enforcement could lead to more stable credit ratings “assuming it lowers M&A event risk and promotes a competitive playing field.”

The heightened scrutiny of deals could financially harm companies that proceed with a partnership or combination that is later successfully challenged in federal court. The DOJ recently won a case that requires JetBlue and American Airlines to unwind their Northeast Alliance that took effect in 2021, Fitch noted.

The partnership, scheduled to terminate this week, was expected to be a “meaningful revenue contributor” to JetBlue and provide “a margin tailwind.”

Losses in Court

The airline partnership was one of the few cases the FTC and DOJ have successfully challenged since 2021. For example, the FTC abandoned a case against Facebook parent Meta for its planned purchase of a virtual reality startup earlier this year after being rejected in federal court.

But there’s no sign the failed cases will alter the federal government’s course. To handle the renewed emphasis on merger enforcement, the Consolidated Appropriations Act of 2023 raised the FTC’s budget to $430 million for fiscal year 2023, up from $377 million in FY 2022.

As part of the renewed focus on M&A deals, the FTC has also proposed changes to the Hart-Scott-Rodino merger review process, including an increase in filing fees for large transactions and a significant expansion of the kind of information and documents parties to a deal must provide to the antitrust agencies, according to David Polk.

The public is invited to provide comments on the draft guidelines by September 18.