As great as the demands are on a CFO at a publicly held Fortune 500 company, it’s perhaps just as demanding to run finance at a small, growth-stage private one.

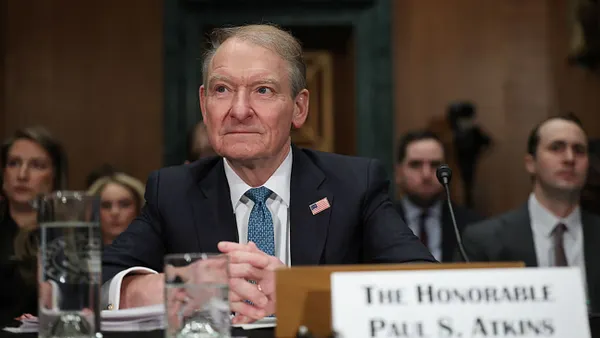

David Blanke

Done well, it may require spending large blocks of time on evaluating technology tools to perform tasks that the small staff can’t handle; learning to use the key tools down to the details, with a roll-up-your-sleeves mindset; hiring and developing people, then more people, then more; being an operator as much as a finance person; and, of course, ceaselessly scaling for growth.

That job description is spot-on for David Blanke, chief operating officer at Sailthru. He was both finance chief and COO until this year, when the firm abolished the CFO position and consolidated finance duties within the COO role. As such, he still leads the finance function.

The 160-employee firm — whose current annual revenue is in the “tens of millions,” according to Blanke — provides brand-awareness technology that its client companies use to build relationships with customers. Blanke has been on the job since mid-2012, before which he was a managing director at The Financial Times. He joined the London-based daily newspaper in 2008 upon leading the sale of his then-employer Money-Media, where he was CFO, to the Times.

Blanke recently met with CFO to discuss his demanding job, his views on the evolving role of finance chiefs at young, growing companies, and how technology in particular is central to that evolution. An edited version of the conversation follows.

What, exactly, does Sailthru do?

The vision of the company is that no two consumers experience a brand in the same way. So we personalize that experience, sending messages and content via email, mobile apps and our clients’ websites. We have individual profiles on every one of our clients’ customers. We know, for example, what devices each one uses, the time of day he or she is most likely to engage with the brand, and what kinds of content are most important to that individual. Maybe someone likes financial news and baseball. We put that content right in front of that person, at the right time, on the right device and in the right channels.

What are your top priorities?

Capital allocation is very important. Do we invest more on the West Coast, or maybe in EMEA? What product development is needed so that we continue to grow, and in the right direction? I look at the big-ticket initiatives that drive strategy, identify the measurements of success for those, and make sure we have an execution plan in place to deliver on them.

Two and a half years is a long stretch at a fast-growth company like Sailthru. How has your job changed?

It’s the difference between building the foundational wooden framework of a house, and layering concrete and floors on top of that. A couple years ago, the product was up and running, there was an established demand for it, and we had basic client-services sales support in place. But there was little process around how to operate each function efficiently. We didn’t have a lot of thinking around our total available market, how we were attacking that, what types of sales reps we were hiring, what was the strategic importance of account managers, and what investments we needed to make to get where we wanted to go.

Hiring is a really big component of the job, not only for me but the whole executive team, and is a good example of how things have changed. My first week on the job, I was handed a list of 50 positions we were trying to fill. It showed the titles, and that was it. I started to go through the list with the recruiter we were using. I said, “What is this person going to do? How are we going to measure success? What is the expected compensation? What are the 5 to 10 bullet points around that role? Who owns the recruiting process to make sure we’re going after the right people?” We had none of those questions answered. By the time we were done with that conversation hours later, the list was down to 20 positions.

That’s emblematic of basic processes and rigor that need to be implemented in an organization in its earlier days, so that you have the foundation to scale. Today, the conversation around hiring is very different. We know exactly who we’re looking for, what they’re going to be doing and whom they’ll report to. The question now is, how do we train them properly to be successful and retain them so they continue to contribute? Those are much bigger questions than how to build basic infrastructure so we can operate.

How confident were you that in cutting out 30 positions you weren’t overlooking something that the company really did need?

You have to balance rigor and speed. Could we have missed some people that would have been important? Absolutely. Do I think we got it 80% to 90% right? Absolutely. I think if you’re moving fast and can get it right to that degree, you’ve done really well.

What’s your perspective on being a combined CFO and COO?

I try not to get stuck on the letters. I don’t think they tell you too much. In my experience the role is not being a CFO and it’s not being a COO. It’s whatever you would call it when you pull those responsibilities together. Maybe chief execution officer, if you will.

It’s an inward-facing, very complementary role to the CEO. A CEO who’s out and constantly talking to investors and customers obviously lives the mission, vision and culture of the company. In a lot of organizations, what works really well is a complementary inward-facing person who has a very deep knowledge of the financials and how to apply that knowledge to smart business decisions. That’s what the mashing together of the CFO and COO roles means to me.

CFOs at growing technology companies tend to be pretty tech-savvy. How does that wherewithal come into play in your job?

I would answer that in two ways. The first is from an investment standpoint. CFOs have to understand the costs and operations around having a data center on the one hand, and the cost and infrastructure of being in the cloud on the other hand.

The second way is about using technology to do your job better. If you as a CFO don’t understand how the technology works, you should at least know what it does. When I got here we were using QuickBooks for core finance and accounting. Since then we’ve switched to NetSuite, which is much more robust. But you know, I think a lot of companies should stay on QuickBooks longer than they do.

Why is that?

There’s a danger in switching over too early. Cloud-based packages like NetSuite and Epicor are attractive for their flexibility, but it still takes a lot of work to optimize them and get them working very smoothly. Companies without a big finance team might not put enough effort and thought into the implementation, whereas if they’d stayed on QuickBooks they could have more systematically built up over time toward having a more robust reporting system in place.

It’s one of those things that people don’t want to talk about. You don’t want to publicly claim that hey, we’re a $100 million company and we’re on QuickBooks. But if you have a team that can extract the information they need and put it into Excel for slicing and dicing, you can get what you need from it. Now, you are going to hit a wall at some point, and I wouldn’t advocate trying to make it do things it’s not capable of doing. But you definitely want to stretch it to the limit before you make the leap, because when you do you can have a good plan in place for a successful implementation.

What other technology tools are you using?

We also have Salesforce, Marketo for lead nurturing, and products from some earlier-stage companies like Gainsight for analytics around customer success — how a customer is using your product, how you are upselling them based on that usage and their behavior with the product, and the danger zones where someone’s usage is dropping off. We also use ZenDesk, a customer-support tool that gives indicators around the usability of your product.

How deeply do you need to understand these kinds of tools?

I think it’s critically important for the CFO to understand technologies — not every single one the company uses, but those that drive key business decisions that are tied to the company’s success. In a small or midsize company environment you don’t necessarily have a data and analytics team or a full-blown FP&A team to make sense of all this. A lot of it is rolling up your sleeves and getting the job done on your own, or at least asking the right questions of the people delivering this data to you.

For instance, with the data that’s being delivered from Salesforce and Marketo, not having a finance layer that’s rigorously testing for reliability and accuracy is a risk. You’re getting the data from people who don’t necessarily have that rigor or don’t understand what you’re asking for.

Is that need for engagement in technology heightened at a tech company?

I think so. The pace at which growing tech companies work is break-neck.

Right now we’re evaluating an early-stage tool called Bizible for marketing-investment analysis. We’re looking at spending more on conferences versus channels like search-engine marketing and public relations. We’ve spent a considerable amount of time aggregating data around that from different sources. Can we put that investment into a tool that can pull that information together quickly? A product like Bizible possibly could do that for us. In a very competitive environment where we need to act very quickly, having tools like that to enable smart business decisions is absolutely crucial.